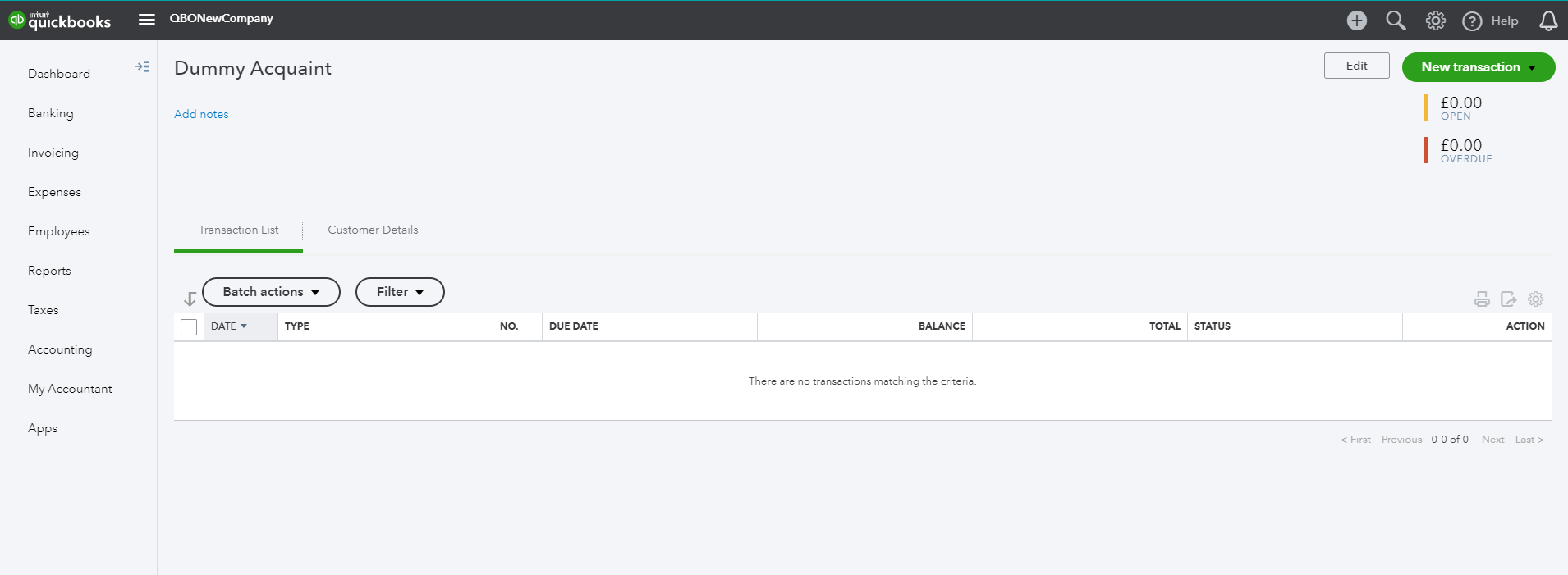

Before inputting for the very first time create a dummy Acquaint record as a contact in your accounting software. Once created you are ready to input figures into your Accounting software. You will only need to do this once and once set-up you will record all the transactions against this single record.

Example:

All subsequent sales invoices should be raised against this same dummy Acquaint record.

Note: We recommend that you do this on a monthly basis in arrears (e.g. In September input profit figures for August)

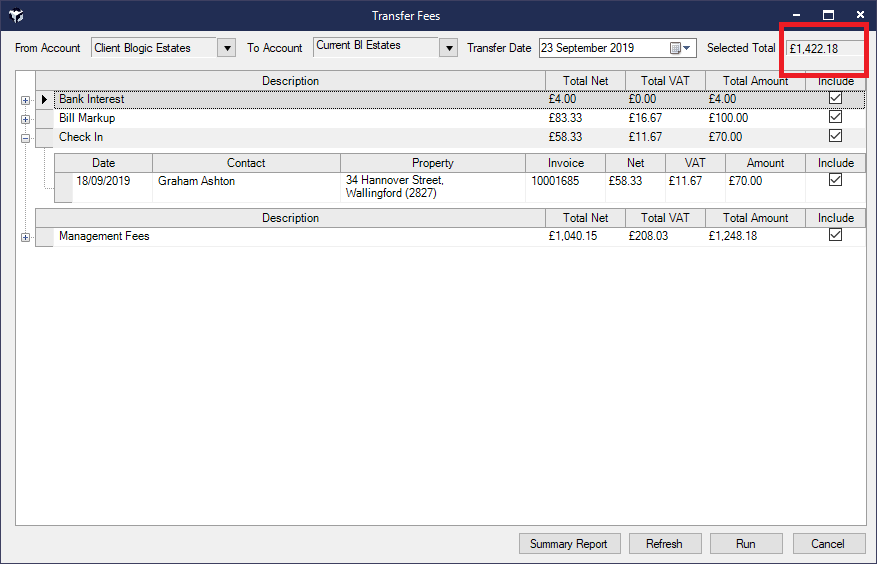

1. Go to the Transfer Fees screen in Acquaint via the Financial tab ->Account Transfers - > Transfer Fees

2. Tick on all the fees you wish to transfer

3. Make a note of the Selected Total in the top right hand corner

4. In your accounting software receive a payment of the total amount of fees transferred against the dummy Acquaint record (as described in the Initial Configuration above).

5. Assign the payment to any outstanding Sales Invoices against that dummy Acquaint record record starting with the oldest first.

Note: This can be done as often as desired