Overview

Closed Periods allow you to close your books at the end of a financial period and lock your financial records, adding this layer of protection to your transaction assists in preventing accounting issues and discrepancies in the Bank Account Balance report. A warning appears if you are making a financial change that will impact your closed period.

Acquaint has the following two types of Closed Periods:

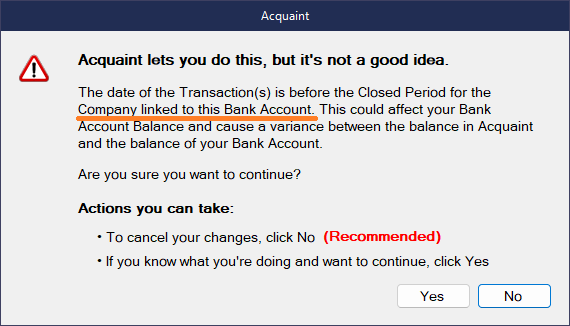

If a user creates, edits or deletes a transaction on or before the end date of the last Bank Reconciliation for the Bank Account a warning prompt will appear. If you have added a Company Account Close Period if a user creates, edits or deletes a transaction on or before the date a warning prompt will appear.

You do not need to close out your Bank Reconciliation Close period, Acquaint automatically creates them using the Bank Reconciliation dates. Thus the end date of the latest Bank Reconciliation automatically would be the end of the Closed Period.

Transactions dated on or before the Closing Date cannot be changed without overriding the warning.

Deleting a Bank Reconciliation will also delete the respective Closed period.

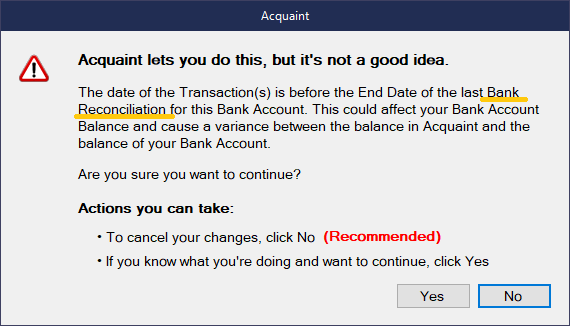

When a User tries to create a transaction on or before the end date of the last Bank Reconciliation for the Bank Account a Closed Period prompt will be displayed advising the User not to continue.

To continue the User must click the 'Yes' button and enter the Closed Period Password. The Closed Period Password can be changed in System Configuration -> Financial -> Closed Period Password. By default this is set to 'confirmed'. The password is case sensitive.

Once a User enters the password the transactions will successfully be created and an Event Log Entry will be written to say that they ignored the prompt.

If a User clicks 'No' on the Closed Period prompt they are returned to the previous screen and will be able to adjust the date before clicking the Save/Run button again.

If the date on the screen is after the last Bank reconciliation for the account the prompt will not be displayed and the screen will function as normal.

User Settings govern whether User has access to change the Closed Period Password.

Scenario

If you raised a fee, unpaid, within a VAT quarter then this may be included in the reports that you uses to calculate your VAT return. As the fee is unpaid, and not Bank Reconciled you can potentially delete this, making the submitted VAT return incorrect. Having a Closed Period in place would warn you.

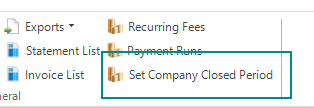

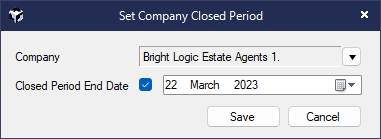

On the Financial tab click Set Company Closed Period. Permissions are required in User Settings for Accounts -> Edit permission.

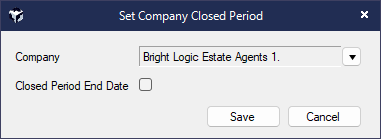

A Set Company Closed Period screen will be displayed. Select the check box and enter the end date for the closed period.

After this the Closed Period End Date field will default to the last Closed Period for the selected company.

Transactions dated on or before the Closing Date cannot be changed without overriding the warning.

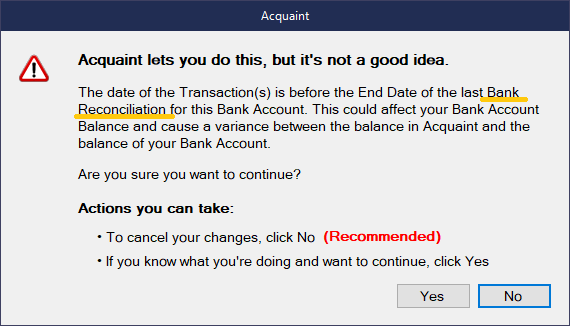

When a User tries to create a transaction on or before the end date of the last Company Closed Period for the Bank Account a Closed Period prompt will be displayed advising the User not to continue.

To continue the User must click the 'Yes' button and enter the Closed Period Password. The Closed Period Password can be changed in System Configuration -> Financial -> Closed Period Password. By default this is set to 'confirmed'. The password is case sensitive.

Once a User enters the password the transactions will successfully be created and an Event Log Entry will be written to say that they ignored the prompt.

If a User clicks 'No' on the Closed Period prompt they are returned to the previous screen and will be able to adjust the date before clicking the Save/Run button again.

User Settings govern whether User has access to change the Closed Period Password.