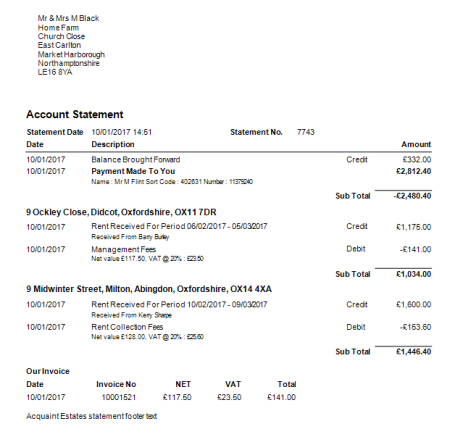

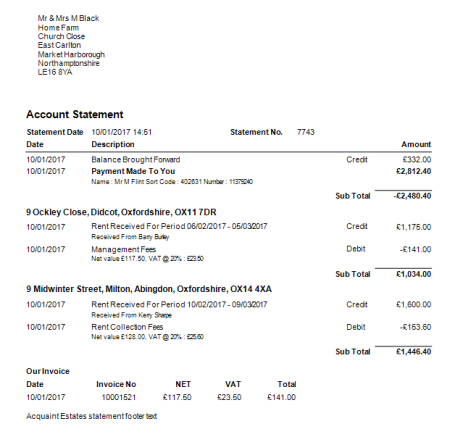

The Consolidated Payment Run produces a payment statement in a consolidated format for the Landlord, an example is provided below:

Example: Consolidated Payment Run Statement

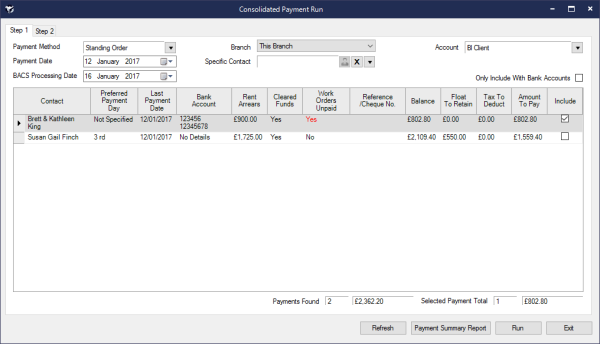

This screen lists all Contacts with Consolidated Payments ticked on (in More Details) whom need to be paid, i.e. whose Account is in credit.

This screen can be accessed either from the 'Consolidated Payment Run' button on the Financial tab or from the 'Consolidated Payments' Home Page Reminder.

The Payment Run process will update the Landlord's Account by posting a Payment Made transaction, with the option to post and/or email the Statements.

Any future transactions are excluded by the function. e.g. if a Tenant pays their rent early is will only be included on the Landlord's payment when its Due Date is reached.

THE CONSOLIDATED PAYMENTS OPTION CANNOT BE REVERSED. Once Consolidated Payments is selected for a Landlord and Consolidated Statements exist in the Account screen, this option will be disabled preventing you from deselecting/reversing it.

- Contact - the name of the Tenant

- Preferred Payment Day- this is the date specified in the Landlord's More Details screen stating their preferred payment date

- Last Payment Date-this is the last date they were paid via the Payment Run.

- Last Statement Date - the date of the last payment made to the Contact

- Bank Account - Sort Code and Account number of the Contact

- Rent Arrears any rent outstanding to them

- Cleared Funds- indicates whether payments should be made or not. Note for Contractor payments their Payments are only set as "Cleared" once a Payment / Statement has been made for the paying Landlord

- Work Orders Unpaid - indicates whether there are any outstanding Work Orders against the Property

- Reference/Cheque No - a reference for the payment that can be type directly into the field

- Balance - the total payment due

- Float to Retain - a float can be kept against a Landlord in their Consolidated payment settings.

- Tax to Deduct - for overseas Landlords (with a FICO number)tax can be deducted at source

- Amount To Pay - this is the actual amount that will be paid and is calculated as follows:

Balance - Float to Retain - Tax to Deduct = Amount to Pay

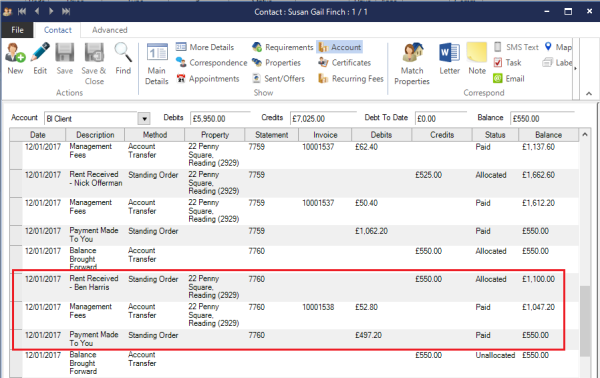

• A Payment Made To You Transaction for the Contact, for the payment amount. This will be a Debit to give the account a Zero Balance.

• A Payments Export File detailing credits for each Landlord. The Payments Export File can be imported into other software packages. This can be accessed in Step 2.

STEP 2 - Produce Payment Run Statements

Once the Payments process has been completed the Produce Statements screen will be appear enabling you to produce the Statements.

The Payments Statements in Acquaint include integrated invoices so invoices do not have to be produced separately.

Split Landlords can't be used with Consolidated Payments. If a Landlord has Consolidated Payments switched on you won't be able to set-up Split Landlord payments for them.

Once switched on Consolidated Payments cannot be turned off.