Payment Run - Paying Contacts (Landlord, Contractors)

The Payment Run screen is used for bulk paying of Contacts.

Typically this will be Landlords and Contractors, but can also be Tenants when processing a refund from their Deposit Account.

The Payment Run function can also be accessed via Financial tab -> Payment Run. It produces a list of Contacts whose Account is currently in Credit i.e. they require payment.

The Help topic on Paying Contractors can be found here.

The Payment Run process will update the Landlord's Account by posting a Payment Made transaction.

Any future transactions are excluded by the function. e.g if a Tenant pays their rent early is will only be included on the Landlord's payment when its Due Date is reached.

STEP 1 - Make Payments to Contacts (Landlords, Contractors etc)

- Click the 'Landlords to Pay Home Page Reminder. The Payment Run screen will list each Contact that needs paying.

- The Bank Account can be selected, as can the Payment Method that will be used to make the payments to the Contacts. The Payment Date is the date the payment is being made and can be back dated as required. This can only be set 7 days in the future. BACS Processing Date can be specified for the Payment Export File it creates. The Contact Type filter enables you to specify the type of Contact you are paying whether this is a Landlord, Contractor, Utility Supplier etc.

This shows the following details for each Contact. (Some additional fields appear for Landlords).

- Contact - the name of the Tenant

- Property - the name of the Property that the Payment relates to

- Last Payment Date - the date of the last payment made to the Contact from the payment run

- Rent Due Date- the date the rent is due

- Rent Arrears - Rent arrears for the Property

- Warnings (shown in red)

- Uncleared Funds - indicates whether payments should be made or not. Note for Contractor payments their Payments are only set as "Cleared" once a Payment/ Statement has been made for the paying Landlord.

- Unpaid Work Orders - indicates whether there are any unpaid Work Orders against the Property

- No Bank Details - if they are missing bank details

- Reference / Cheque No - a reference for the payment that can be type directly into the field

- Balance - the total payment due

- Float to Retain - float can be kept against each property in the Details #3 screen

- Tax to Deduct - for overseas Landlords (with a FICO number) tax can be deducted at source

- Amount To Pay - this is the actual amount that will be paid and is calculated as follows:

Balance - Float to Retain - Tax to Deduct = Amount to Pay

- Include - a checkbox allowing the selection of payments that have been received i.e. when the Tenants payment (Standing Order/Cash/Cheque) has cleared.

- You can select which payments you want to include on the Payment Run by clicking the check box under the Include column. These are payments that have been received i.e. when the Tenants payment (Standing Order/Cash/Cheque) has cleared.

- Optionally you can perform a number of functions from the Menu button

- Tick All

- Untick All

- Payment Summary Report - produce a report of the payments you have selected by clicking the Payment Summary Report button. When viewing the report changing the Detail Level will show the Contact's Bank Details you are paying into.

- Set Float Amount - set the Landlord's float amount

- Pause/Unpause Payments - hold back a landlord from Payment Runs.

- Find

- Export Grid to Excel

- Find

- Click the Run button and you will be taken to Step 2.

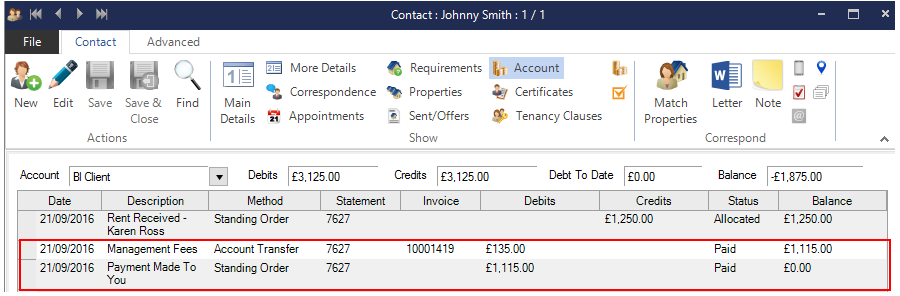

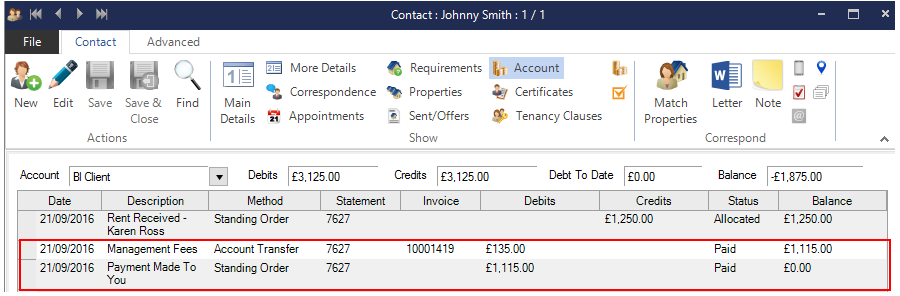

- When run, the following Transactions are automatically created:

• A Payment Made To You Transaction for the Contact, for the payment amount. This will be a Debit to give the account a Zero Balance.

• A Bulk Payments Exportfile detailing credits for each Contact. The Payments Export File can be imported into other software packages. This can be accessed in Step 2

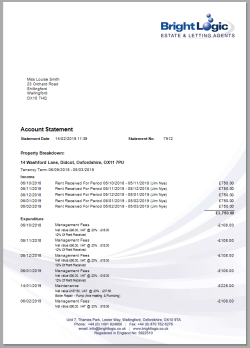

STEP 2 - Produce Payment Run Statements

Once the Payments process has been completed the Produce Statements screen will be appear enabling you to produce the Statements.

The Payments Statements in Acquaint include integrated invoices so invoices do not have to be produced separately.

- If the Use Contacts Preferred Delivery Method i.e. Email / Post /Both is selected then the Statements will be produced in the format that the Landlord has set in their preferred delivery method in the More Details screen.

- Choose to Preview / Print to view the Statements and optionally print a copy for your records. This produces a copy of all statements regardless of the Contact's preferred. Delivery Method.

- Choose to Preview / Print for Posting this option prints a copy to post based on their Marketing Preferences.

- Choose Email to produce Emails and automatically attach Statements as a .PDF.

- Choose the View button to open the Payments File.

- When you've finished click Exit and if you are satisfied the Statements were correct click Yes and the transactions will be created otherwise click No and you will be able to run the Payment Run again.

Example Payment Run Statement

Easily pay your Landlords using the Landlords to Pay reminder on the Home Page. When clicked on, this will display the Payment Run screen.

-

If a Bank Reference is not entered for a Contact (i.e. left blank) then the first line of the related property address will be used.

If a Contact (i.e. a Landlord) is associated with multiple Properties then each Property will be treated and listed separately. Optionally, you can group all a Landlord's Properties on one Statement by switching on Consolidated Payments for the Landlord.

-

For the Monthly Statements:

-

Prior to producing Statements the Process Tenant Payments and Payment Run functions should be run first in order to bring Accounts up-to-date

-

Each Statement produced is allocated a unique Statement ID.Transactions included on Statements are highlighted on the Accounts tab for each Contact

-

Once a Transaction has been included on a Statement it cannot be Edited or Deleted

-

If a Statement is produced for a Landlord who owes money then the system creates a Balance Brought Forward Transaction of the outstanding amount to act as the starting point for the next month's Statement. Balance Brought Forward Transactions are automatically excluded from Transaction Reports.

- If Bank Details have been added against a Contact these are automatically printed on their Statement.

Definable Footer Text can be added to Statements. This is defaulted to the value entered in Configuration & Administration ->System Configuration ->Statement Footer Text but can be modified / entered when producing Statements. A typical use for this would be to enter VAT Registration details or seasonal messages

Undo a Statement

If a Statement has been produced in error it can be reversed by finding the relevant Contact and clicking the Statement button on their Accounts screen.

If your Contact has multiple properties you must select the Property that the Statement is for in the Properties filter on the Account screen first before undoing the Statement otherwise you will get the message 'There was No Statement to Undo'.

Reprinting Statements

Previously produced "monthly" Statements can also be reprinted for individual Contacts from their Account tab and click Menu -> Payment Run Statements - View/Email Previous option or through the Statement List.

Example - Paying Landlords

- On Home Page (Financial tab) click Landlords To Pay

- Against Contact Type ensure Landlord is selected

- Select which payments you want to include on the Payment Run by clicking the check box under the Include column.

- Click Run